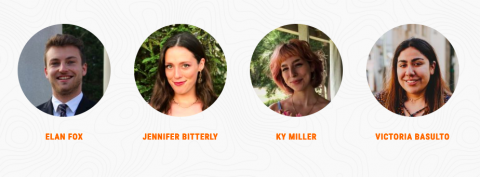

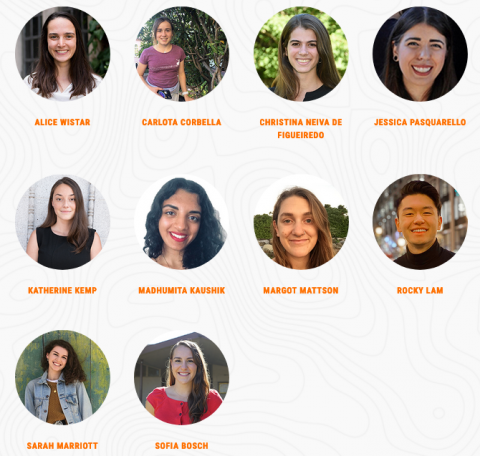

Spring 2024 Update: PiLA Welcomes its 2024/25 Cohort

(April 15, 2024) Princeton in Latin America is pleased to announce our 2024/25 cohort of fellows, the first since operations were suspended during the Covid pandemic. This year’s cohort will include 14 fellows who will be working with 6 host organizations in Costa Rica, the Dominican Republic, Guatemala, and Mexico.